Budget consultation

It’s part of our vision to be guided by what matters to our residents. Your views genuinely shape the decisions we make, and we want to hear from you as we prepare to consider the budget for the 2026-27 financial year.

Just like household bills, the cost of running our services continues to rise because of inflation. At the same time, our District is growing, bringing greater demand for the services we provide. This means we are having to deliver more for our communities without any additional government funding.

We are also facing the ongoing impacts of the cost of living. It costs more for us to provide essential services, and we are seeing increasing pressure in key areas such as homelessness, where many local families are struggling to access or remain in private rented housing or take their first step onto the property ladder.

The results of this consultation are available in the downloads panel at the bottom of the page, or see our consultation results page.

Our financial position

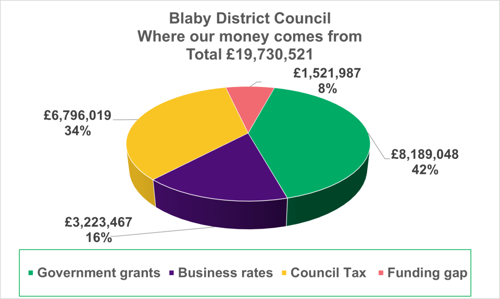

For 2026–27, the proposed budget need is £19,730,521.

The budget supports a host of different services that support our communities, including Housing, Environmental Health, Community Services and many more. The majority of our funding comes from Government grants, Business Rates, and Council Tax.

For 2026/27 the proposed budget is:

| Portfolio | Proposed Net Budget for 2026/27 |

| Finance, People & Performance | £6,667,226 |

| Housing, Community Safety & Environmental Services | £2,995,956 |

| Health, Leisure, Climate and Economic Development | (25,648)* |

| Leader (including Democratic Services, Electoral Services and Local Government Reform) | £3,908,012 |

| Neighbourhood Services & Assets | £3,107,365 |

| Other (including Revenue costs of Capital expenditure) | £1,834,462 |

| Total | £19,730,521 |

*Leisure income offsets the expenditure

Before using any of our reserves, and without any increase in Council Tax, we are forecasting a funding gap of more than £1.5 million for 2026-27. By law, the Council must set a balanced budget, so we will need to find ways to bridge this gap, either by increasing income, reducing our spending, releasing reserves, or a combination of these.

We have also received government funding projections for the next three years. Even after using some of our reserves, we are still forecasting further shortfalls of around £336,000 in 2027-28, rising to £1.4 million in 2028-29. This means the financial decisions we make now will impact on our future budgets.

Where our funding comes from

Government grants provide 42% of our income and Business Rates provide 16%, both of these are important income streams, but Council Tax makes up 34% of the money we rely on to deliver services across the District.

Please note: the Council Tax percentage could change if the funding gap is filled by using reserves.

Council Tax

As the District Council, it’s our responsibility to collect Council Tax, but the amount we keep is only a small amount of the total bill. The majority of what we collect is passed onto other authorities that provide essential services in the area, including Leicestershire County Council, the Office of the Police and Crime Commissioner, the Fire Authority, and the Town and Parish Councils.

For every £1 of Council Tax you pay (approximate figures):

- 70p goes to Leicestershire County Council

- 12p to the Police

- 4p to the Fire and Rescue Service

- 6p to Parish Councils

- 8p stays with Blaby District Council

This means we retain only 8.09% of the total Council Tax collected. In 2025-26, this equated to just under £6.8 million of the £83.5 million collected across the District.

If the maximum 2.99% Council Tax increase is agreed for 2026-27, our share of the Council Tax bill would be £200.61 per year for a Band D property - a rise of £5.82 per year, which works out to just 11p per week.

Our budget consultation 2026

Our consultation on the budget for 2026-27 ran from 20 January 2026 to 16 February 2026. Thank you to everyone who shared opinions on spending.

The results are being reviewed before all responses are considered alongside professional advice from Council officers and input from elected members across political groups.

A summary of what you tell us will be included in the report to Full Council when the budget, and any Council Tax changes, are agreed on Tuesday 24 February.